You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If you think saving the planet is nonsense then I wish you would move to another one

- Thread starter BillArnett

- Start date

13_gecko_rubi

New member

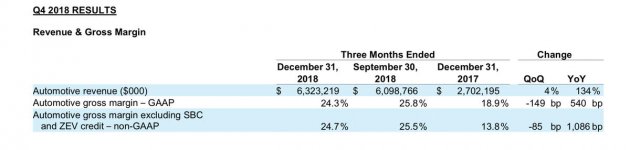

Wow I've missed tons of replies lolThat was a minor but significant factor in the past but it is no longer. According to their 2018 Q4 financial report they only got $768,000 (thousands, no typo) in ZEV credits that quarter. Gross automotive revenue was $6,073,471,000 (billions, no typo) for that quarter.

ZEV credits are something totally different. They are selling tens of millions of GHG credits (that's not same as ZEV). I am sure they are baked into the "automotive revenue bucket). And posting revenue numbers means nothing. You can have $10,000 billion in annual revenue and still have negative profit.

Sent via....

BillArnett

New member

Wow I've missed tons of replies lol

ZEV credits are something totally different. They are selling tens of millions of GHG credits (that's not same as ZEV). I am sure they are baked into the "automotive revenue bucket). And posting revenue numbers means nothing. You can have $10,000 billion in annual revenue and still have negative profit.

Sent via....

Thanks for pointing that out; I didn't know there were different kinds of credits.

From the 2018 10K: Total automotive revenues: $18,514,983,000; "ZEV credits sales were $103.4 million and non-ZEV regulatory credits sales were $315.2 million in the year ended December 31, 2018". So all the credits still amounted to only a little more than 2% of revenue. A 2% change in revenue can be a big deal for a mature company in a stable, efficient market. But Tesla is growing very rapidly and the market is changing, too, in ways that are hard to predict. 2% change in revenue one way to the other won't matter. What matters most is the demand for Tesla's cars after the initial euphoria about the Model 3 wears off.

(BTW, next week Tesla will announce a "small SUV". It won't be a Wrangler competitor but maybe it'll be a step in that direction?)

13_gecko_rubi

New member

Sure thing. And again you missed the revenue part. If they sell a vehicle for revenue but the cost is higher than the revenue (which they are) that's still a big loss. That 2% increase in revenue for credits which have zero cost is the only thing they are actually making money on. That's my point, take away the credit sales and they lose money still to this day. A lot of it. Look at FCAs revenue (or any major auto company) it's ridiculously high but their actual profit isn't that high relative to revenue. 2018 FCA Revenue $130B, net profit $4B. Roughly 3%.Thanks for pointing that out; I didn't know there were different kinds of credits.

From the 2018 10K: Total automotive revenues: $18,514,983,000; "ZEV credits sales were $103.4 million and non-ZEV regulatory credits sales were $315.2 million in the year ended December 31, 2018". So all the credits still amounted to only a little more than 2% of revenue. A 2% change in revenue can be a big deal for a mature company in a stable, efficient market. But Tesla is growing very rapidly and the market is changing, too, in ways that are hard to predict. 2% change in revenue one way to the other won't matter. What matters most is the demand for Tesla's cars after the initial euphoria about the Model 3 wears off.

(BTW, next week Tesla will announce a "small SUV". It won't be a Wrangler competitor but maybe it'll be a step in that direction?)

Sent via....

doubletapdaddy

Caught the Bug

With regards to the poll added to this thread...

The outcome is inconsequential. On more than one occasion the proprietor of this forum has asked the OP to leave. That is all that matters. Whether or not the OP's assertions and opinions are valid or legitimate is no longer of interest. If I ask someone to leave my home, I do not expect my guests to vote on it. I expect that person to get the fuck out. Now, my verbage is not indicative as to whether or not I agree or disagree with the OP. My grievance is based on the OP's unwillingness to adhere to the wishes of the proprietor. Rather than participating in a poll, the more appropriate action is highlighted below.

The outcome is inconsequential. On more than one occasion the proprietor of this forum has asked the OP to leave. That is all that matters. Whether or not the OP's assertions and opinions are valid or legitimate is no longer of interest. If I ask someone to leave my home, I do not expect my guests to vote on it. I expect that person to get the fuck out. Now, my verbage is not indicative as to whether or not I agree or disagree with the OP. My grievance is based on the OP's unwillingness to adhere to the wishes of the proprietor. Rather than participating in a poll, the more appropriate action is highlighted below.

Piginajeep

Moderator

With regards to the poll added to this thread...

View attachment 9521

The outcome is inconsequential. On more than one occasion the proprietor of this forum has asked the OP to leave. That is all that matters. Whether or not the OP's assertions and opinions are valid or legitimate is no longer of interest. If I ask someone to leave my home, I do not expect my guests to vote on it. I expect that person to get the fuck out. Now, my verbage is not indicative as to whether or not I agree or disagree with the OP. My grievance is based on the OP's unwillingness to adhere to the wishes of the proprietor. Rather than participating in a poll, the more appropriate action is highlighted below.

View attachment 9522

[emoji23][emoji23]

Well said.

2019 MP

2012 JK8

1958 FC170

1954 M38A1

BillArnett

New member

Sure thing. And again you missed the revenue part. If they sell a vehicle for revenue but the cost is higher than the revenue (which they are) that's still a big loss. That 2% increase in revenue for credits which have zero cost is the only thing they are actually making money on. That's my point, take away the credit sales and they lose money still to this day. A lot of it. Look at FCAs revenue (or any major auto company) it's ridiculously high but their actual profit isn't that high relative to revenue. 2018 FCA Revenue $130B, net profit $4B. Roughly 3%.

Sent via....

I just didn’t want to get into a long discussion of TSLA’s financials. I’m not an accountant. But it’s not quite right to say they’re losing money on each car. The “gross margin” on each car is positive about 20%. The reason that doesn’t result in a net profit is that they have spent huge amounts in capital investments to increase their production capacity in addition to the usual overhead costs. For 2019 capital expenditures will be less and production higher so the outlook for actual net profit is pretty good.

The best measure of a company’s value is it’s “market capitalization”, the price times the number of shares outstanding. For Tesla that’s about $50 billion, FCA’s is about $20 billion even though FCA’s revenue is about 5x larger and profitable while Tesla is still losing money. Why the disparity? Because Wall Street thinks that IN THE FUTURE Tesla’s earnings will improve. A lot. And they’ve bet $50 billion that they’re right. (And this is not all that unusual for a growth company. It’s just unusual to see a growth company in the automotive space.)

And I still don’t want to talk about their financials. What really matters is how many cars they can sell. Right now they can’t built them fast enough. Start worrying about Tesla’s financials when you see the first Tesla advertisement on TV; that will indicate that the demand has leveled off and Tesla will have to start operating like a mature company. Til then, comparisons with the majors can be misleading.

13_gecko_rubi

New member

LMFAO, you definitely aren't an accountant. 20% gross margin... You must live in a state that legalized weed and smoke a lot of it. Even the well established premium vehicle brands don't have 20% gross margin per vehicle. And your assessment of "huge capital they've spent" is comical, every auto company does that, annually.I just didn’t want to get into a long discussion of TSLA’s financials. I’m not an accountant. But it’s not quite right to say they’re losing money on each car. The “gross margin” on each car is positive about 20%. The reason that doesn’t result in a net profit is that they have spent huge amounts in capital investments to increase their production capacity in addition to the usual overhead costs. For 2019 capital expenditures will be less and production higher so the outlook for actual net profit is pretty good.

The best measure of a company’s value is it’s “market capitalization”, the price times the number of shares outstanding. For Tesla that’s about $50 billion, FCA’s is about $20 billion even though FCA’s revenue is about 5x larger and profitable while Tesla is still losing money. Why the disparity? Because Wall Street thinks that IN THE FUTURE Tesla’s earnings will improve. A lot. And they’ve bet $50 billion that they’re right. (And this is not all that unusual for a growth company. It’s just unusual to see a growth company in the automotive space.)

And I still don’t want to talk about their financials. What really matters is how many cars they can sell. Right now they can’t built them fast enough. Start worrying about Tesla’s financials when you see the first Tesla advertisement on TV; that will indicate that the demand has leveled off and Tesla will have to start operating like a mature company. Til then, comparisons with the majors can be misleading.

Market capitalization has no relation to how a company is doing actually making money. That's all wall street projections on future earnings.

I actually work in automotive and actually know what those EV parts cost, they aren't making much on the premium ones like the S and are losing on the 3. But keep leaving in your fairy tale world.

Sent via....

BillArnett

New member

LMFAO, you definitely aren't an accountant. 20% gross margin... You must live in a state that legalized weed and smoke a lot of it. Even the well established premium vehicle brands don't have 20% gross margin per vehicle. And your assessment of "huge capital they've spent" is comical, every auto company does that, annually.

Market capitalization has no relation to how a company is doing actually making money. That's all wall street projections on future earnings.

I actually work in automotive and actually know what those EV parts cost, they aren't making much on the premium ones like the S and are losing on the 3. But keep leaving in your fairy tale world.

Sent via....

I read it on the internet so it must be true that gross margins for the automotive industry average about 11%.

From their last quarterly report: “Model 3 GAAP and non-GAAP gross margin > 20% in Q3”

Am I reading this wrongly? I could believe that Tesla’s manufacturing is somewhat more efficient than the others but by that much?

I don’t doubt your automotive expertise. But maybe the parts you see aren’t the same as Tesla’s? They make their own batteries and motors. Maybe they’re less expensive than what’s available to FCA?

Or maybe there’s some funny accounting going on? But it would equally hard to believe they could get away with that for long given the scrutiny of Wall Street and the SEC.

ddays v2

Member

BillArnett

New member

...your assessment of "huge capital they've spent" is comical, every auto company does that, annually...

I guess I should have said “relatively huge”. Tesla more than doubled the number of cars sold in 2018 vs 2017. Of course, Tesla didn’t spend the kind of capital that FCA and the other biggies did in absolute terms. But as a fraction of their expenditures it was relatively huge.

You no doubt know better than I how hard it is to start up production of a whole new model, especially if it’s a completely new model not based on a previous one. Would you agree, in that case, that the first year entails an unusually large capital expenditure? And that the second year of production will come in at a significantly lower cost than the first?

BillArnett

New member

You mean like the CEO?

I’m not going to defend Elon Musk. He’s a crazy man. And totally burned out from working 100 hour weeks last year (no exaggeration). But to be fair, he has taken Tesla from nothing 13 years ago to a $50 billion valuation producing 100s of thousand of cars per year and created over 40,000 good American jobs. I just wish he would dial back the antics and concentrate more on the business.

Edit: I should add that back in the Roadster days when Tesla was just a 200 person company I had a couple of opportunities to interact with him personally. He is VERY IMPRESSIVE. Flat out brilliant.

Last edited:

13_gecko_rubi

New member

The second year is definitely lower investment wise. Variable cost typically stays flat or even increases over time due to monetary escalation from suppliers. You try to offset that with cost reduction ideas but it's generally very small changes over time. Tesla doesn't have an investment issue, there are enough crazy saps to give them cash. They have a cost vs sales price issue, ie margin issue. You cannot sell a profitable EV at $35k at least not any time soon. Maybe 5+ years from now, the costs are coming down.I guess I should have said “relatively huge”. Tesla more than doubled the number of cars sold in 2018 vs 2017. Of course, Tesla didn’t spend the kind of capital that FCA and the other biggies did in absolute terms. But as a fraction of their expenditures it was relatively huge.

You no doubt know better than I how hard it is to start up production of a whole new model, especially if it’s a completely new model not based on a previous one. Would you agree, in that case, that the first year entails an unusually large capital expenditure? And that the second year of production will come in at a significantly lower cost than the first?

As soon as you launch the vehicle you start working on the next enhancement which is only a few years away generally and hundreds of millions of dollars in investment.

Sent via....

BillArnett

New member

The second year is definitely lower investment wise. Variable cost typically stays flat or even increases over time due to monetary escalation from suppliers. You try to offset that with cost reduction ideas but it's generally very small changes over time. Tesla doesn't have an investment issue, there are enough crazy saps to give them cash. They have a cost vs sales price issue, ie margin issue. You cannot sell a profitable EV at $35k at least not any time soon. Maybe 5+ years from now, the costs are coming down.

As soon as you launch the vehicle you start working on the next enhancement which is only a few years away generally and hundreds of millions of dollars in investment.

Sent via....

My guess is that Tesla is going to struggle to break even on the $35k models this year. But the average selling price for all versions of the Model 3 will be much higher; I’m guessing around $50k. Fully loaded Model 3s are about $65k (before credits).

Tesla’s “mission” is to electrify the auto industry. To that end, they’re doing everything they can to bring the prices down. It would be easy for them to make lots of money selling Model S and X. But that’s not good enough. They’ll make just enough profit to satisfy Wall Street and keep growing as fast as possible. (Think Amazon: they went for years with zero profits. And now Bezos is the richest man in the world.)

13_gecko_rubi

New member

He was... Now him and his soon to be ex wife will be half and half lolMy guess is that Tesla is going to struggle to break even on the $35k models this year. But the average selling price for all versions of the Model 3 will be much higher; I’m guessing around $50k. Fully loaded Model 3s are about $65k (before credits).

Tesla’s “mission” is to electrify the auto industry. To that end, they’re doing everything they can to bring the prices down. It would be easy for them to make lots of money selling Model S and X. But that’s not good enough. They’ll make just enough profit to satisfy Wall Street and keep growing as fast as possible. (Think Amazon: they went for years with zero profits. And now Bezos is the richest man in the world.)

Sent via....

BillArnett

New member

...As soon as you launch the vehicle you start working on the next enhancement which is only a few years away generally and hundreds of millions of dollars in investment.

Sent via....

Enough with the financials. What do you think of Rivian? Assuming they’re successful does FCA need to respond somehow? Would that reponse be an electric Wrangler or something all new? If you were designing an electric Wrangler would you keep the transfer case and everything downstream of that? Or two or four motors? Rivian claims to have a very strong high tech “skid plate” under their battery (lots of layers, some metal, some carbon fiber, they’re not saying details). Or would it be better to just use a 1/4” steel plate? What metric would you use for range? What could you do to make off-road range closer to highway range?

Or what about Bollinger? It’s interesting that to a first approximation Rivian and Bollinger are doing the same thing. But their approaches couldn’t be more different.

Both of them need to make a deal with Tesla to use the Supercharger network. That would be a win for everyone.

13_gecko_rubi

New member

Well you will notice the Rivian styling looks very Jeep like because most of them came from FCA, specifically the Jeep team lol.Enough with the financials. What do you think of Rivian? Assuming they’re successful does FCA need to respond somehow? Would that reponse be an electric Wrangler or something all new? If you were designing an electric Wrangler would you keep the transfer case and everything downstream of that? Or two or four motors? Rivian claims to have a very strong high tech “skid plate” under their battery (lots of layers, some metal, some carbon fiber, they’re not saying details). Or would it be better to just use a 1/4” steel plate? What metric would you use for range? What could you do to make off-road range closer to highway range?

Or what about Bollinger? It’s interesting that to a first approximation Rivian and Bollinger are doing the same thing. But their approaches couldn’t be more different.

Both of them need to make a deal with Tesla to use the Supercharger network. That would be a win for everyone.

It's also why they are doing an amazing job at touting it's off road capability. Because many of them are former Jeep employees.

As for does anyone need to respond, that's yet to be seen. It is a cool concept for sure. They claim to be going to market but many of the specs they tout are also somewhat theoretical. Amazon investing in them gives me a little more feeling it may become reality, but $700M they invested isn't enough. It sounds like a huge number but an all new vehicle design and manufacturing setup runs $2-3B now days. I still think it's awesome to push the boundaries. I worked on EV Humvees for the military when I was in college. The torque was awesome. I give them kudos. I definitely like the styling way better than Tesla. The SUV anyway, the truck not so much. We will see.

The Rivian isn't a Wrangler competitor and wouldn't touch it off road wise. It would be more comparable to a trail rated Grand Cherokee. That is fine depending what you do for it.

If you asked me how to make an EV Wrangler it would have 4 wheel end motors, a crazy suspension design due to all the freedom independent wheel end motors gives you, independent steering at each wheel, etc etc. I would go crazy with it. But I am a little crazy lol.

The Bollinger is interesting too but that's more a niche thing imo. They gave it a 10k gvwr to put it in commercial class so doesn't need most safety things etc. They have gear boxes for each motor then also a 2 speed "transfer case" on each motor set too. So weird and what happens when u try to use off the shelf motors. I don't know, I weirdly like it though lol.

It all depends on the market whether one should or should not respond, you need customers who actually want these things. Tesla owners will argue til blue in head how great they are (case and point this thread

Skid wise I don't think id want carbon fiber. But I really don't know, maybe it's ok? I think a good 7075 aluminum skid would be better. I think range equivalent to one tank in a gas vehicle is fine, once u can charge it in 5 min or less like filling tank. Off road range will always be less than on road. Increasing it would beat be done by the driver. Using max Regen braking versus mechanical.

As for the supercharger network, Tesla will lose that battle as more and more folks enter the market because unlike Tesla and their stupid proprietary charge network the rest of the world uses a standard charging system just like all gas pumps are the same.

I'm not against EVs, I just don't want them forced down my throat. Think about computers, back in the day they were size of garage. My smart phone has more computing power than those did. EVs will get there. Some of the new battery tech is focused specifically on super fast charge times. Like 90% charge in under 10 min. It's just super expensive now. It will come down, just depends how long.

Sent via....

BillArnett

New member

Hah! That's good to know.Well you will notice the Rivian styling looks very Jeep like because most of them came from FCA, specifically the Jeep team lol.

It's also why they are doing an amazing job at touting it's off road capability. Because many of them are former Jeep employees.

They had another $500M round earlier. They claim that they now have enough to start production. We'll see. Maybe they'll make a partnership deal with someone to do the actual manufacturing.As for does anyone need to respond, that's yet to be seen. It is a cool concept for sure. They claim to be going to market but many of the specs they tout are also somewhat theoretical. Amazon investing in them gives me a little more feeling it may become reality, but $700M they invested isn't enough. It sounds like a huge number but an all new vehicle design and manufacturing setup runs $2-3B now days.

Agreed. I'm not a fan of Rivian's headlights but that's a trivial matter. Rivian would come a lot closer to Wrangler capabilities if they made some provision for bigger tires. How hard is that?I still think it's awesome to push the boundaries. I worked on EV Humvees for the military when I was in college. The torque was awesome. I give them kudos. I definitely like the styling way better than Tesla. The SUV anyway, the truck not so much. We will see.

The Rivian isn't a Wrangler competitor and wouldn't touch it off road wise. It would be more comparable to a trail rated Grand Cherokee. That is fine depending what you do for it.

Tesla's "pickup truck" may be revealed this summer. Elon promises way-out radical styling. But also said once that if that bombs they'll do something more conventional. I have less than zero expertise in that domain

If you asked me how to make an EV Wrangler it would have 4 wheel end motors, a crazy suspension design due to all the freedom independent wheel end motors gives you, independent steering at each wheel, etc etc. I would go crazy with it. But I am a little crazy lol.

What's a "wheel end motor"? Do you mean the motor integrated with the wheel so there are no driveshafts and u-joints? That's my dream design, too. It adds an awful lot of unsprung weight which is going to suck on the highway. But combined with a beefy wheel and a 37" tire maybe it wouldn't be all that much worse.

And if you're really lucky (and the regulators see reason) you can also eliminate the brakes and go with 100% regen braking. That saves a bunch of weight to offset those wheel motors. And is probably more reliable, too. The problem is you have a huge power level to deal with; the battery has to be capable of being recharged at a much higher rate than would otherwise be necessary. But see below. You might have to just dump the energy into a humongous resister. That would probably be super reliable but would it be cheaper than conventional brakes?

Did you mean independent steering on the rear wheels, too? That would be cool. Tricky to control though. Two steering wheels? Maybe the computer just makes the rear wheels precisely follow the fronts?

I like the Bollinger's massive ground clearance. And the styling is retro cool. My issue with it is the range. Only 200 miles. That would be OK most of the time for me but it would be a pain driving from here to Moab or Colorado. Rivian's 400+ is more like it.The Bollinger is interesting too but that's more a niche thing imo. They gave it a 10k gvwr to put it in commercial class so doesn't need most safety things etc. They have gear boxes for each motor then also a 2 speed "transfer case" on each motor set too. So weird and what happens when u try to use off the shelf motors. I don't know, I weirdly like it though lol.

Tesla is going to produce a new Roadster in the next couple of years. Very sexy. 0-60 in 1.9 seconds. 250+ mph top speed. $200,000+ Definitely supercar. Microscopic market, of course. Halo car.It all depends on the market whether one should or should not respond, you need customers who actually want these things. Tesla owners will argue til blue in head how great they are (case and point this thread) but at end of day all EV handraisers account for less than 3% of auto buying market. Supercar handraisers are higher. I think it will go up over time. The government pushing it will help some

Yeah. That's certainly a big deal. But as I said before, it's probably not as bad as you think. In some use scenarios the relatively slow re-fueling time is a pain (long trips with tight schedules). In other scenarios the EV actually wins (commuting with recharge at work or at home). YMMVbut the big thing as I've said many times is it needs to be as convenient to use as a gas powered vehicle to really hut mainstream.

Example math: if want a 300 mile range that will require roughly a 100kWh battery. If you want to recharge that in 5 minutes (1/12 hour) you'll need an average power level of 1200 kW. That's 1.2 MEGAWATTS. At 1000 volts that's 1200 amps. That's possible but expensive. Tesla is working on liquid cooled charging cables for just such a scenario but don't hold your breath. Tesla and some of the others are talking about 200 or 300 kW chargers in the near future, though. That might get charge times down to 10 or 20 minutes. That's really not much longer than it takes to take a piss and grab a soda.Skid wise I don't think id want carbon fiber. But I really don't know, maybe it's ok? I think a good 7075 aluminum skid would be better. I think range equivalent to one tank in a gas vehicle is fine, once u can charge it in 5 min or less like filling tank. Off road range will always be less than on road. Increasing it would beat be done by the driver. Using max Regen braking versus mechanical.

There are at least 3 "standards" in addition to Tesla's (CCS, CHAdeMO, another in China). It's a typical standards war. Tesla's is far more convenient but that's almost irrelevant. Someday this will settle out. Probably with the worst of all possible choices.As for the supercharger network, Tesla will lose that battle as more and more folks enter the market because unlike Tesla and their stupid proprietary charge network the rest of the world uses a standard charging system just like all gas pumps are the same.

I agree that Tesla will probably lose the standards war in the USA. The end result will probably be a bunch of adapters for old Teslas and the addition of new standard cables in the Supercharger network. Meanwhile, owing a Tesla is a lot easier in this respect than the other EVs since they have access to the Superchargers and some of the others. That's a big advantage which Tesla didn't want

The situation is better in Europe. All (including Tesla) EVs sold in there use the CCS standard. Same (with a different standard) in China.

(And the gas pumps may all be the same but there are almost always 3 different kinds of gas and often diesel, too. Kinda like having different charging plugs in the same location.)

I'm not against EVs, I just don't want them forced down my throat. Think about computers, back in the day they were size of garage. My smart phone has more computing power than those did. EVs will get there. Some of the new battery tech is focused specifically on super fast charge times. Like 90% charge in under 10 min. It's just super expensive now. It will come down, just depends how long.

Sent via....

The first computer I worked on wouldn't have fit in Eddie's garage. And it had less computing power than my watch.

I agree battery tech is improving. And getting cheaper. But I think charging times will bottom out at about 10 minutes. We might see a variety of chargers with different costs and power levels (hopefully all compatible at the rate the car can handle).